oregon 529 tax deduction carry forward

The new tax credit would be in addition to any carry forward benefits. Yes - According to the Oregon College Savings Plan website.

If you currently take advantage of this option you are able to carry forward your unused subtraction over the following four years.

. Tax Benefits of a 529 Plan. At the end of 2019 I contributed 24325 to carry forward. Oregon has an additional incentive.

Consider a couple that contributes 25000 to their new babys Oregon 529 Plan account in 2019. Youd get your carry forward tax deduction plus the tax credit for the new money you contributed. They contributed 10000 to the Oregon 529 plan in 2019.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. The new tax credit would be in addition to any carried forward deductions. You may carry forward the balance over the following four years for contributions made before the end of 2019.

Subject to annual limits. The maximum annual tax savings in this case goes from 48213 to 78213 for married filers who had the maximum carry over under the 2019 rules and the maximum credit-eligible contribution under the 2020 rules. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

Visit individual plan websites for current information about fund expenses minimum. Among Americas Best Plans. The Oregon College Savings Plan is the name of Oregons 529 Plan.

Out-of-state participants still get the federal tax benefits. For example if a couple contributed 15000 to their sons Oregon College Savings Plan account in 2019. State-by-state outline of the various state section 529 plan deductions.

If you made a contribution in a tax year that started before January 1 2020 that was more than. Now fast forward to today. Sumday Administration LLC succeeded TIAA-CREF as program manager of the Oregon College Savings Plan on September 10 2018.

Can claim subtraction and credit on same return. Oregon College Savings Plan Tax Deduction Oregon College Savings Plan Tax Deduction. The contributions to an Oregon 529 plan are tax deductible up to a 2265 annual limit for individuals and 4530 for joint returns.

5 tax credit on contributions of up to 2040 single 4080 joint beneficiary maximum credit of 102 single 204. You also get federal income tax benefits as you do not pay income tax on your earnings. But only on contributions made prior to December 31 2019.

And as with any 529 plan your money grows tax-free. Can I carry forward amounts contributed to an Oregon 529 college savings plan. New Yorks 529 College Savings Program.

OK 529 plan tax deduction. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from contributions in the 2020 year and is not a carryforward from 2019 as it specifies. The advantage of front-loading becomes clear when you compare the savings outcome with regular annual contributions.

Families can deduct up to 4865 worth of these contributions from their state tax returns. Here is where we are at with our Oregon plan at the end of Q1 2017. 4 rows The maximum amount to contribute to qualify for both the deduction and the credit is 24325 for.

UPDATED FOR TAX YEAR 2019. 4960 for MFJ 2480 all others. The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019.

North carolina enhances 529 deduction 08. I have not seen a location to enter my 2020 contributions to the 529 plan. Oregon 529 tax deduction changes.

Single filers can deduct up to 2435. Same subtraction codes 324 for 529 plans 360 for ABLE. 41820 over 6 years.

This deduction is annually indexed for inflation purposes. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. However unlike other plans the Oregon laws do not make it clear if a taxpayer can roll over contributions.

Previously Oregon allowed tax-deductible contributions. Families can deduct up to 4865 worth of these contributions from their state tax returns. You may carry forward the balance over the following four years for contribution.

They would receive a tax deduction of 4865 on their 2019 taxes and could carry forward a deduction of 4865 every year for the next four years as long as their childs 529 Plan balance exceeds the deduction amount at the end of each tax year. Oregon 529 College Savings and ABLE account plans. Five-year carry-forward of excess contributions.

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. You may carry forward the balance over the following four years for contributions made before the end of 2019. Excess contributions made on or before December 31 2019.

The funds offered include VanguardT. Ad Tax-Advantaged College Savings Plan With Low Fees From American Funds. Many states allow up to five years of.

Rowe Price and TIAA. RB40Jr was born in 2011 and weve been saving to his 529 plan since then. If we assume that their Oregon State income tax rate is 10 its actually a bit less than this their 2019 contribution would have resulted in a tax benefit of 487.

For 2019 you can subtract up to 4865 for joint returns or up to 2435 for all other returns for contributions. Contributions must be made to an Oklahoma 529 plan in order to qualify. People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married couples filing jointly.

Here is where we are at with our oregon plan at the end of q1 2017. As an Oregon taxpayer you are eligible for the 2019tax deduction as long as the contribution is made prior to filing your 2019 state tax return or April 15 2020 whichever comes first. You can subtract up to 5030 for Married Filing Jointly returns or up to 2515 for all other returns for carried over contributions made to a 529 Oregon College Savings Network account prior to 2021.

Contributions and rollover contributions up to 10000 for a single return and up to 20000 for a joint return are deductible from Oklahoma state income tax with a five-year carryforward of excess contributions. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college and static investment fund options. May subtract a maximum of 4865 because they file jointly on their 2019 taxes.

The received a tax deduction of 4865. 529 College Savings Plans. We chose the Oregon College Saving Plan because the contribution is deductible up to 4660 in 2017 The Oregon state income tax is pretty high at 9-10.

Front-loading 75000 for example would compound to 180496 at 5 over 18. They can then carry forward the remaining 10135 balance of that contribution for up to four years. And Oregonians can still take advantage of this perk based on the contributions they made before December 31 2019.

Draft Registration Statement Submission No 3

All About Ny S 529 Plan College Savings Program Upromise

Start Saving Program Louisiana 529 College Savings Plan Ratings Tax Benefits Fees And Performance

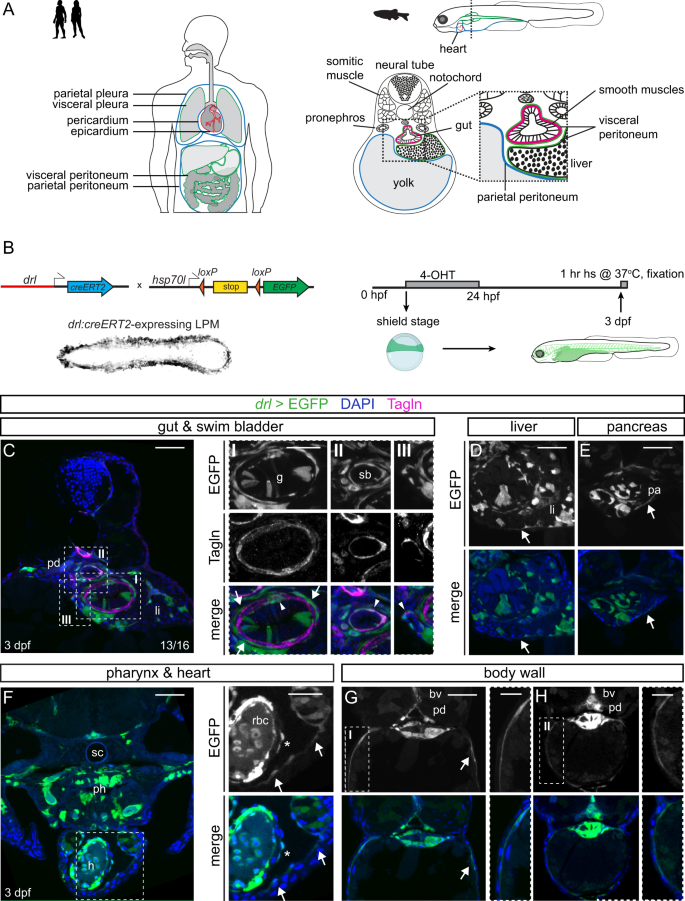

Hand2 Delineates Mesothelium Progenitors And Is Reactivated In Mesothelioma Nature Communications

Arigo Eucor Gmbh Amp Co Kg Wir Geben Marken Sicherheit

Pennsylvania 529 Plans Learn The Basics Get 30 Free For College

Employment And Social Situation In Europe Report 2013

Draft Registration Statement Submission No 3

Start Saving Program Louisiana 529 College Savings Plan Ratings Tax Benefits Fees And Performance